This has been a turbulent week for equities, and many commodities are given fears over COVID-19 making a return and the upcoming Presidential election and general chaos in the United States, given our present administration.

The biggest commodity mover, natural gas (UNG), initially crashed on Monday with an amazing 15% sell-off in two days, on-demand destruction from the recent tropical storms and hurricanes plus lack of any real early fall extreme weather. The market sold back on an oversold situation and the potential for a colder weather outlook for the eastern U.S. (signs of an early winter?).

Grain prices (JJG) took it on the chin because of the upcoming US harvest pressure and dry weather. This was following a 10-20% move up in prices due to stellar Chinese demand and weather issues with their (CORN) crop from three typhoons and flooding rains.

Cocoa prices (NIB) have soared on the recent dry weather in West Africa but more so from political problems in the Ivory Coast.

In the precious metals market, one of the bright spots in commodities over the last 6-12 months, gold (GLD) and silver (SLV) took it on the chin, as it appears that there will not be any new Fed stimulus into the market. Markets that go up this quickly always have a correct, so a 10-20% sell-off is typical, just like it has been in high playing tech stocks.

This short video here shows more about what is going on with global commodities.

Coffee – The Giant Sucking Sound

Here is a little fun from a conversation from two hypothetical coffee traders

Seriously, an enormous oversupply can set off a chain reaction of irrationality. Think of crude oil prices collapse in the WTI futures contract on the NYMEX during the height of the Pandemic that drove the April contract into negative price territory. Such a move is unthinkable in normal times, but this year is far from normal. In the matter of Arabica coffee, the market logistics are quite different. Can you imagine armadas of coffee laden tankers headed for the major roasters? I can’t.

But I do believe the weather fundamentals will become relevant again in the price movement of coffee. “Weather will matter most for this market in the coming weeks.”

The demise of the coffee market has been partly attributed to the enormous global stock situation and production, which has hit the market following the 2015 BULL related El Nino price move.

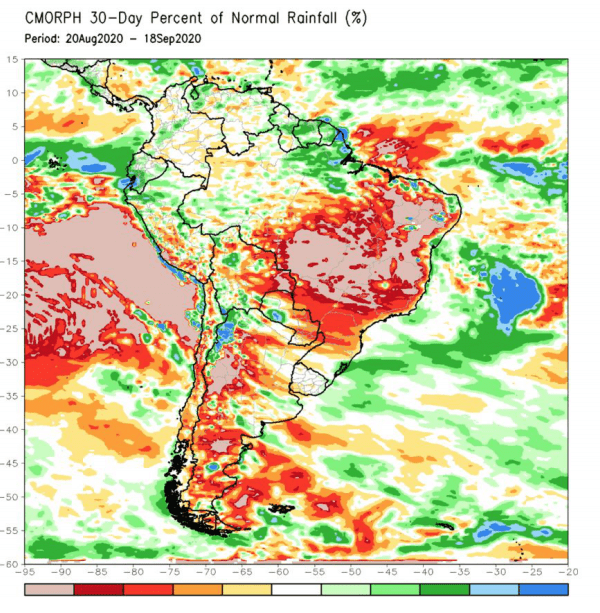

Coffee trees need regular rains for their bloom in October-December (their later spring and early summer). These maps show how, typically, it is strong El Nino events (crop stress you see here back in 2015-16) that cause a sharp reduction in global coffee crops and subsequent higher prices. An interesting full article I wrote about El Nino, La Nina, and coffee can be found here.

One can see the dryness developing in Brazil. If this continues into November, not only it will have a bullish aspect to the coffee (JO) market but commodities such as soybeans (SOYB) also could be affected after the US harvest.

Source: Noaa

Conclusion

The point of my article above is that often traders become bearish at the bottom of some markets and bullish at the top. In the case of coffee, there are still many bearish traders who view present fundamental news as negative for coffee prices. But following the “crowd” is often dangerous and the upside potential for the ETF (JO) is much stronger than the downside risk, longer term.

Other markets beaten up like wheat (WEAT), natural gas (BOIL), and others will be greatly affected by winter weather and the developing La Nina. Hence, with such uncertainty over the stock market and lofty prices in many equities, investing in a broad basket of a commodity ETF program such as Wisdom Tree or Vanguard is definitely advised in the months ahead.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.