Is this the top?

The big, if not biggest, question facing investors is whether inflation has peaked, and Goldman Sachs chief economist Jan Hatzius says it has.

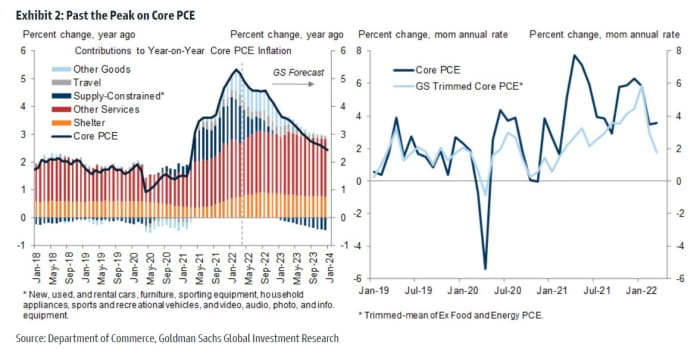

“For the first time since the price surge started in early 2021, we have revised our end-2022 core PCE forecasts down rather than up and are now more confident that both headline and core inflation have peaked in year-on-year terms,” says Hatzius in a note to clients.

Granted, it’s not so much that prices are heading back down, and more the case than year-ago comparisons result in declines in the 12-month percentage gains. But even sequentially, Hatzius says, its core trimmed PCE price index has slowed to just 2% in March.

What’s needed for a soft landing is growth weak enough to persuade firms to shelve expansion plans and close some job openings, but not engage in large-scale layoffs. That’s not really the case yet. “Our jobs-workers gap shows that this process has not yet started in the official data, although alternative indicators of vacancies do show modest easing,” said Hatzius, pointing to data from the National Federation of Independent Business and the recruiting firm Indeed.

Financial markets showed little signs Monday of any stepping off the accelerator by the Fed. Futures on the Dow Jones Industrial Average

YM00,

fell more than 500 points, though the yield on the 2-year Treasury

TMUBMUSD02Y,

eased to 2.69%.

The Labor Department is set to report its latest consumer price index reading on Wednesday.

Hatzius says it will be hard for stocks to rally at the moment. “But while we forecast a recovery in the major equity indices as well as modestly positive excess returns in the credit markets from current levels, the upside potential for risk assets looks fundamentally limited. After all, if the recent tightening of financial conditions was necessary to put the labor market on a more sustainable path, then undoing this tightening via a big rebound in risk asset valuations would be inherently unsustainable,” he said.