Be like Buffett and use the VIX to acquire fear and offer greed in the SPY.

shutterstock.com – StockNews

The VIX at last shut below 30 on Friday and under the 20-working day moving ordinary of 31.20. It is also nearing the critical 27.50 place that served as severe upside resistance for most of September right until it last but not least gave way. Earnings from tech bell weathers Apple (AAPL) and Microsoft (MSFT) future week and the Fed rate determination the subsequent 7 days will probable tell the tale pertaining to route of the two stocks and the VIX into calendar year-finish.

I experienced written an short article in late August on how possibility price ranges can help predict potential stock price ranges. I precisely utilized the VXN -or VIX of the NASDAQ stocks- to demonstrate how the significant pullback in VXN equated to a limited-expression major in NASDAQ shares (QQQ), as proven under.

But fairly than just calling tops, applying an IV based mostly methodology can be a strong current market timing instrument to use to assistance discern turning points in the overall current market from the two a bullish and bearish point of view.

Try to remember, the VIX and VXN are both of those actions of 30-working day implied volatility (IV) in the S&P 500 and NASDAQ 100 respectively. In this post I will explore how applying the VIX can considerably assist in discerning the impending industry motion for the S&P 500 (SPY) both to the upside and the downside.

The chart under demonstrates how prolonged moves better in VIX towards 35 adopted by subsequent weak point has been a bona-fide purchase sign in SPY about the previous year. Conversely, sharp drops lower in VIX with subsequent energy have been good promote indicators in stocks.

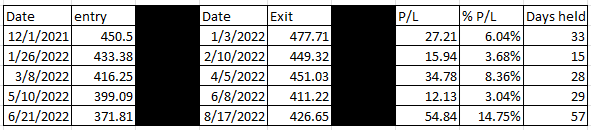

The desk beneath summarizes the first get sign and subsequent provide sign centered on this VIX methodology.

The whole P/L for the 5 get and market alerts is 35.86%, with an normal acquire of just about 7%. Worst achieve was still 3%. Look at that to the all round loss of more than 20% in the SPY about the earlier 12 months.

The typical times held for just about every buy/offer signal was around a month. Overall time held for all alerts blended was a lot less than fifty percent a year. So significant gains in under 50% of the time using the VIX methodology compared to even larger losses keeping SPY all the time.

A new buy sign was created a few weeks ago as the SPY strike annual lows. No market sign evident nonetheless, but the unrealized get on that latest obtain sign is now about 5%.

Using the VIX to help tell no matter whether the SPY is at a turning level is akin to the Warren Buffett adage to be greedy when other folks are fearful and fearful when other individuals are greedy. Undoubtedly, a tiny of the fear has arrive out of the current market if VIX is any information. Nonetheless haven’t attained the greedy amount still so continue to be tuned and see what occurs about the coming weeks!

POWR Solutions

What To Do Next?

If you are looking for the very best solutions trades for today’s current market, you ought to verify out our most recent presentation How to Trade Choices with the POWR Ratings. Listed here we show you how to regularly obtain the best solutions trades, even though reducing hazard.

If that appeals to you, and you want to discover more about this powerful new selections method, then click on underneath to get obtain to this timely investment presentation now:

How to Trade Possibilities with the POWR Rankings

All the Most effective!

Tim Biggam

Editor, POWR Choices Newsletter

SPY shares shut at $374.29 on Friday, up $8.88 (+2.43%). 12 months-to-day, SPY has declined -20.28%, as opposed to a % rise in the benchmark S&P 500 index during the identical period.

About the Author: Tim Biggam

Tim invested 13 several years as Chief Solutions Strategist at Guy Securities in Chicago, 4 yrs as Direct Choices Strategist at ThinkorSwim and 3 many years as a Industry Maker for Initially Possibilities in Chicago. He will make regular appearances on Bloomberg Tv and is a weekly contributor to the TD Ameritrade Community “Early morning Trade Reside”. His overriding enthusiasm is to make the complex earth of selections extra easy to understand and therefore extra practical to the everyday trader.

Tim is the editor of the POWR Choices e-newsletter. Discover additional about Tim’s track record, alongside with inbound links to his most current posts.

The put up How To Use The VIX To Make Greater Inventory Picks appeared initial on StockNews.com