Getty Pictures/iStockphoto

Some of us are previous plenty of to keep in mind the maniacal shopping for that pushed tech shares, several of them extended considering that dead and gone, to nosebleed valuations back in the heady dot-com bubble times of 1999.

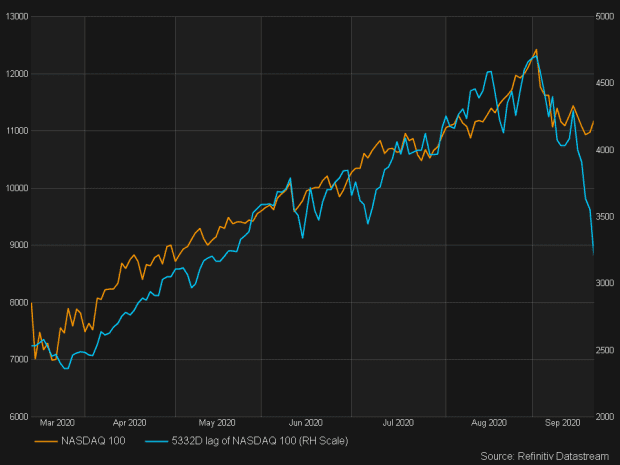

Is historical past repeating alone? Verify out this chart, courtesy of Mott Capital’s Michael Kramer, evaluating the Nasdaq-100

NDX,

back then to the same tech-heavy index currently:

“I observed this to be breathtaking and surprising,” Kramer told investors in a blog post. “I hope this turns out to be completely wrong, by the way.” Extra than just the chart, the quantities he highlighted this week mirror of the action in 1999 virtually just.

From the March 2020 coronavirus-induced lows, the Nasdaq-100 jumped 84% around 163 times. Dial it again a couple decades, and the index rose about 86% more than 151 days. The good reasons for the explosive rally may be vastly diverse, but the paths are, certainly, strikingly similar.

“I really do not know, possibly it is just prospect, but however awfully odd,” Kramer wrote. “I guess we are likely to locate out before long whether the similarities close there.”

At very last check out, the development was continuing in Wednesday’s buying and selling session, with the Nasdaq Composite

COMP,

receiving hit tough, as were being both equally the S&P 500

SPX,

and the Dow Jones Industrial Normal

DJIA,